The June 2024 figures from the Ohio Casino Control Commission make for interesting reading and will reinforce some of the more pessimistic thinking about the US market more generally.

Here, we’ll look at the situation in Ohio, potential interpretations, and offer up more optimistic suggestions for how brands, big and small, can find their niche and compete state by state.

Ohio gaming revenue for June 2024

The dominance of FanDuel and DraftKings is utterly apparent, though there may be some celebration this month as FanDuel recovered the top position with $22.7m in online gross gambling revenue off $159.4m in bets. The latter displaced DraftKings, which generated $15.3m in online revenue from handle of $165.2m.

So, two brands have sucked up $324.9m in bets from a total pool of $529.8m wagered in the state, and this figure includes retail operations. Without the benefit of a time machine, some question how other companies can meaningfully compete given the acquisition costs associated with brand impact in the US.

More than this, in the case of June 2024, statewide revenue and handle fell to a calendar-year low — so even as year-on-year figures are up, are brands potentially going to battle it out for an even smaller share of the pie as the market matures?

Third place was taken by international powerhouse bet365 with $4.6m in revenue from a $52m handle.

Of the others in the state, only BetMGM, ESPN Bet, and Fanatics saw revenue in excess of $1m, and these have invested heavily in advertising, brand, partnerships, PR, and digital.

Finding your niche in the US landscape

Some commentators who were bullish about the US have turned in a more cynical direction. A similar situation also seems to be emerging in Brazil and other ‘new’ markets, with breathless positivity turning to pessimism in certain quarters.

For those used to working in mature markets, it feels like there’s more acceptance that there will be ups and downs and consistent work required alongside the ability to ‘pivot’ when required.

We wonder if the presence of VC funds new to gaming and over-optimistic retail brands with less affinity for digital marketing methodologies helped normalize costly acquisition strategies that are not sustainable for ‘normal’ brands.

A lot of money is being spent on betting, customer familiarity with online betting is increasing, and income/population levels are compelling and, while regulations are obviously in place, there are more restrictive jurisdictions in the world.

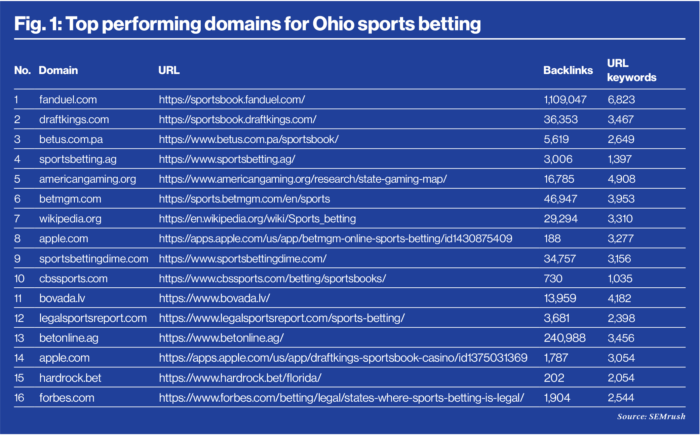

The rankings for ‘sports betting’ in Ohio (see Fig. 1, below) show the continued presence of informational and ‘informational affiliate’ sites such as Wikipedia and Legal Sports Report, but how traditional media sites are also essentially serving as gateways to betting.

For example, the Apple URL is for BetMGM’s app, CBS Sports’ page is a list of sportsbooks, and it’s similar with Forbes, which, in spite of the recent manual actions against big sites ‘misusing’ their clout to rank for ‘irrelevant’ content, is ranking for a presumably monetized article.

Of course, there are hundreds of keywords we could potentially analyze. But this tiny snapshot is intriguing with how operator sites have bubbled to the top, and this perhaps implies that affiliates (and the mainstream media) will need to work harder to rank given Google (and potentially audience) preferences for transactional sites.

Missteps and opportunities

A view we held upon writing for the last issue of EGR North America was that, for some US brands, it’s not that there’s no SEO thinking — it’s that the SEO thinking is comparatively dated and why, by accident or design, media companies are scooping up so many top rankings. And it’s hard not to maintain this view.

We’ve found it hard to see brands flatline or, in the case of brands such as Tipico, get acquired for a tech stack/state access with pretty horrible implications for the teams working there.

It’s notable that the ranking URL for many brands in Ohio is a homepage or a generic category page, which could also be due to a lack of more appropriate rankable content and a lack of topical drilldown.

The US landscape in 2025

Capitalizing on SEO opportunities requires balancing multiple strategies in both ‘normal’ battleground states like Ohio and potentially game-changing states like California.

In the case of the Golden State, the opportunity feels especially present, despite the anticipated dominance of well-established brands.

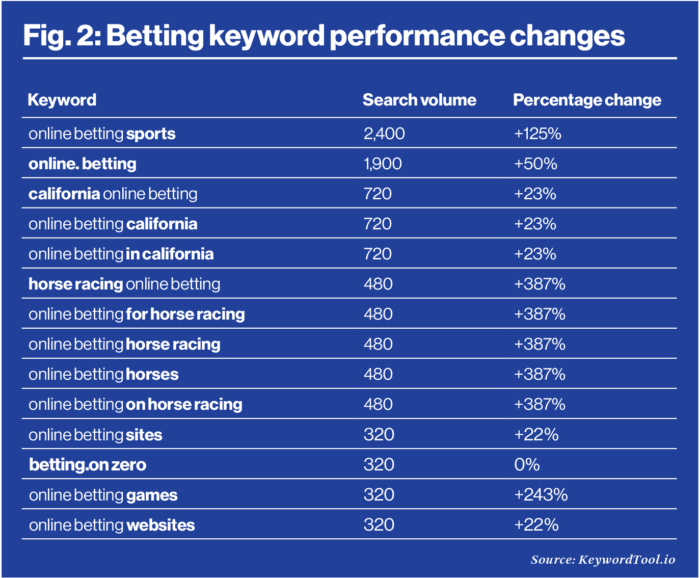

Fans of California’s 19 professional sports franchises have contributed to search queries for online betting-related topics with, in some cases, a triple-digit percentage increase in the past 12 months.

Gaming searches in general have remained flat statewide, but add ‘online’ as a qualifier and the picture becomes clear; the anticipation for regulated gambling over the internet is at a high — for instance, the high-intent term ‘online sports betting’ has surged 125% year on year. Elsewhere, some queries, particularly relating to horse racing, have risen 387% (see Fig. 2, below).

To capitalize, carrying practical, honest, and realistic keyword research is essential. This can involve identifying niche keywords with lower competition but high relevance, recognizing where ‘the big two’ will dominate for the foreseeable future and using a sensible range of tools like Keyword Planner, SEMrush, and Ahrefs to uncover realistic opportunities.

It’s striking how many operator sites have unimpressive mobile experiences, and this is one area where, as new states come online, affiliates may be able to claw back some advantage.

Creating ‘high-quality’ content — debatable, as that term is based on Google’s manual and algorithmic actions/promotion of user generated content this year — and ‘engaging’ content that is well organized can help users and search engines.

With this in mind, we remain grumpy optimists about the future potential of the US market — if brands commit to a life beyond paid media and big-splash ads.

link